Table of Contents

- SCHD 복제 - YouTube

- SCHD Top 20 Holdings (Part 1) - How SCHD Makes Money for Investors ...

- SCHD 단점, 최근 종목 교체 관련 알아보기

- Most Investors Are Wrong About SCHD... - YouTube

- Honest discussion about SCHD : r/dividends

- SCHD 장단점 7가지 지금 체크해보세요.

- Why Dividend Investors Love SCHD (Is SCHD a good investment) - YouTube

- SCHD: I Was Wrong; It's Still A Loser In Today's Market | Seeking Alpha

- Discover the POWER of SCHD: A Dividend Growth ETF! - YouTube

- SCHD를 낮은 주가에서 꾸준히 매수하면 벌어지는 일 - YouTube

What is SCHD and How Does it Work?

What Changed in the Rebalancing?

What Does This Mean for Investors?

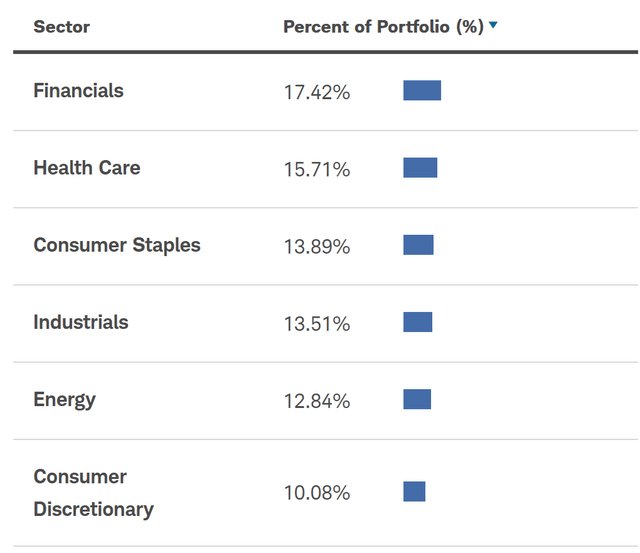

The rebalancing of SCHD may have a significant impact on investors, both positively and negatively. Some of the key implications include: Potential for increased dividend income: The addition of new high-dividend-paying stocks may lead to an increase in the overall dividend yield of the ETF Changes in sector allocation: The rebalancing may result in a shift in the sector allocation of the ETF, which could affect its overall performance Increased diversification: The addition of new stocks and the removal of others may lead to a more diversified portfolio, reducing the risk of over-exposure to specific industries or companies The recent rebalancing of the Schwab U.S. Dividend Equity ETF (SCHD) is a routine process aimed at maintaining the ETF's dividend-yielding characteristics and ensuring it continues to track the underlying index accurately. While the changes may have a significant impact on investors, they also present opportunities for increased dividend income and diversification. As with any investment, it's essential to carefully consider your individual financial goals and risk tolerance before making any decisions. By understanding the changes and their potential implications, investors can make informed decisions and navigate the ever-changing landscape of the financial markets.For more information on SCHD and other investment opportunities, please visit our website or consult with a financial advisor.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor or conduct your own research before making any investment decisions.